Difference between revisions of "Finance"

| (2 intermediate revisions by the same user not shown) | |||

| Line 36: | Line 36: | ||

==Shipping Charge Management== | ==Shipping Charge Management== | ||

| + | [[File:Shipping Charge Management.png|thumb|right|Shipping Charge Management]] | ||

| + | |||

| + | Shipping Charge Management is a very simple section with only one tickbox. Tick this box to default shipping charges to being VAT exempt, if you require this at your organisation. Please discuss with your Finance Team before selecting this option. | ||

| + | |||

| + | <br/> | ||

==Event Ticket Postage Charge (Remote Sales)== | ==Event Ticket Postage Charge (Remote Sales)== | ||

| + | [[File:Postage Charge Management.png|thumb|right|Postage Charge Management]] | ||

| + | This section is only relevant if you are posting event tickets by mail rather than using eTickets. | ||

| + | The first checkbox, '''Setup Postage Charge''', is simply a saftey switch to allow you to edit the fields below it, otherwise they will blanked out. | ||

| + | |||

| + | In the '''Postage Charge''' textbox you would enter the monetary value you are charging for postage of events' tickets and the last tickbox, '''Postage Charge VAT Exempt''' is to choose whether your postage is VAT exempt or not, exactly the same as in the previous sections. | ||

Latest revision as of 10:04, 27 July 2018

Finance is a stub, and just part of a wider section on UnionCloud Setup, for the full UnionCloud setup index please check the page here.

As an administrator, you can use this section to set-up several options regarding finance on your site, such as nominal codes, service charge and shipping charge management. However, before making changes in this section we recommend you speak to your finance staff and consult the documentation.

Contents

Nominal Code

In the first section of Finance is where you can set-up configurations for nominal codes which you may use within your site. Nominal codes are unique reference numbers which your Finance staff will use for tracking where to allocate funds when downloading a Finance Report. They are useful for auditing and keeping track of your finances.

In this section you will see two checkboxes. Ticking the first box, Disable nominal code, will remove this option from your site and can be useful if you do not use nominal codes or wish to organise your finances in another manner.

Ticking the second box, Make nominal code mandatory, will make nominal code a required field on all pages which it appears on throughout UnionCloud. Users will not be able to move from the page or save without selecting a nominal code.

Under these two options there is a textbox which asks for you to Please enter nominal code format (this box will be blanked out if you have disabled nominal codes). This is where you would enter your standard format for nominal codes, similarly to how you set-up formats for University IDs and Library Cards. For example, NOM[0-9]{5} means that your standard nominal code format is NOM followed by 5 numbers, e.g. NOM73946.

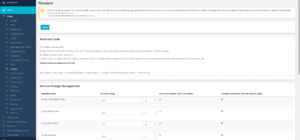

Service Charge Management

The next section of Finance is where you can set-up any service charges or transaction fees for any of the products which you sell on UnionCloud. This may be used to cover the transaction fees which you are charged for selling through the platform. We impose a minimum service charge for transactions to cover our own handling costs, depending on your contract type we also set a capped upper charge. Please consult your contract or contact us if you need clarification.

You are able to enter a service charge for 4 types of products which you can sell on UnionCloud:

- Group Membership Type

- Group Event Ticket

- Union Event Ticket

- eShop Products

The amount that you enter here can be either a set fee in £s or as a % of the product price, click on the dropdown next to the Service Charge to swap between £ and %. The charge that you enter here will be added to the product price when users purchase the item.

Each service charge has two optional tickboxes:

- Show transaction fee to students - Ticking this box will show the transaction fee, as a separate value, to users who purchase a product. If this is not ticked then users will only see the overall total price and not the separation into product price and fee.

- Exclude transaction fee for remote sales - Ticking this box will mean that transaction fees are not applied to Remote Sales purchases. Remote Sales are usually offline cash purchases, so therefore will not warrant the usual processing fee that online transactions require. It is hence probably best practice to keep these boxes ticked so that you are not incurring an unnecessary fees on users.

If you are using the % format for service charges, you can also enter a minimum and maximum fee into the boxes below the blue banner.

The last portion of service charge management is a Transaction Fee VAT Exempt tickbox. Checking this box will make all your products defaulted to VAT exempt, which is useful if you know that most of your sales will be exempt from VAT. Please check your requirements for this with your Finance Team.

Shipping Charge Management

Shipping Charge Management is a very simple section with only one tickbox. Tick this box to default shipping charges to being VAT exempt, if you require this at your organisation. Please discuss with your Finance Team before selecting this option.

Event Ticket Postage Charge (Remote Sales)

This section is only relevant if you are posting event tickets by mail rather than using eTickets. The first checkbox, Setup Postage Charge, is simply a saftey switch to allow you to edit the fields below it, otherwise they will blanked out.

In the Postage Charge textbox you would enter the monetary value you are charging for postage of events' tickets and the last tickbox, Postage Charge VAT Exempt is to choose whether your postage is VAT exempt or not, exactly the same as in the previous sections.